Summer is not technically over until morning on the 22nd of September this year at my location but culturally it always seems that summer lasts from Memorial Day weekend until Labor Day. The leaves are turning and therefore it seems summer came and went but nothing changed much. MacBeth might observe it was full of sound and fury signifying nothing. The oil markets are still uncertain and bad data are searched for any indication of where oil prices are headed tomorrow. Oil prices were up nearly $4 per barrel in two days this week evidently based on a large draw from US storage (following a small draw) and concerns over the effect of Iran sanctions. Then they went down and then up again.

Analysts continue to debate whether market moves are caused by the possibility of Iran going out of the market by stopping exports, or not, or by some unknown amount, new tariffs, old tariffs, Volt sales figures, Elon’s whiskey and weed show, birth rates, Chinese oil imports, trade disputes, Venezuela’s oil shipments to Cuba, Hurricane Florence, etc., etc. President Trump is still doing his best to keep markets guessing. Extensive oil market prognostications in business and financial press reach no consensus. Oil prices fluctuate without clear direction. The oil price goes up one day and down the next.

The oil market is the largest international market and operates without clear and accurate information with trading of the last marginal barrel determining the price of every barrel of oil worldwide. The only thing worse was when all oil was traded on a spot market with no reporting.

Is this any way to run a modern economy?

In late 2014 OPEC, led by Saudi Arabia, attempted to maintain market share by increasing production during a period of oversupply to force prices down and drive American shale drillers out of business. Many companies declared bankruptcy but the strategy failed to decrease US production as much as it reduced OPEC revenues. After two years the Saudis and OPEC, with Russia and other non-OPEC producing countries, abandoned the strategy and cut production to increase prices. This production cut was largely successful; oil prices increased from the $35 to $40 range to the present $65 to $75 range.

With higher prices American shale drilling recovered and continues even more efficiently to increase US production. US oil production doubled during the last dozen years and delayed a world supply shortage – much to the surprise of governments, OPEC, Russia, China, banks, other financial organizations, and the industry itself.

Other trends are overwhelming the rate of US production increase, however, and a crude shortage is expected in 1 ½ to 3 years.

In 2014, when OPEC forced prices down, worldwide surplus production capacity was about 2.5 million barrels per day (b/d), mostly in Saudi Arabia with a little in Kuwait and the UAE, in a 96 million b/d market.

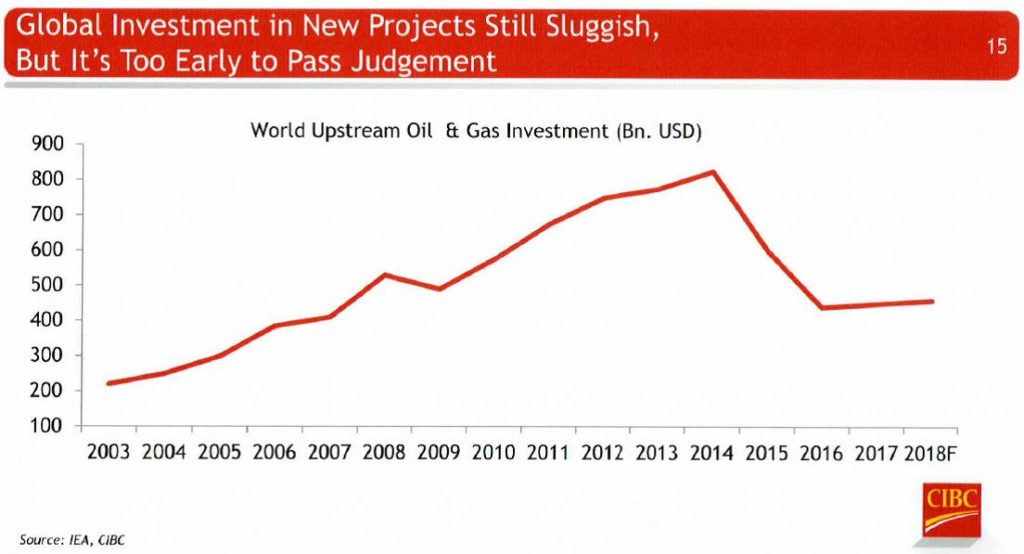

The severe reduction of oil prices caused a dramatic reduction of worldwide investment in large supply projects, as shown on the plot published by CIBC. Many projects worldwide were cancelled or postponed thus severely reducing new supplies of oil coming onstream in the next 3 to 7 years.

Worldwide demand is now about 100 million b/d and continues to increase about 1.5 million b/d each year, so the OPEC plus Russia production cuts have been reduced. With US production increasing by about 0.9 million b/d, historic world production declining 5% to 7% per year, and investment in new projects diminished, it becomes apparent shortages will develop in late 2020 or 2021, if not before. As with all commodity markets for which prices are determined on the margin in open trading, small imbalances cause large price changes. Thus, significant oil price increases can be expected in 1 ½ to 3 years.

So when looking back over the summer, although one can conclude no big changes took place one can also detect tensions developing in the markets. The oil market is approaching balance and balances are always unstable – unless outside forces impose rigidity.

The feeling of increasing tension in the oil market is enhanced by impending sanctions regarding Iran to become effective in November. These sanctions will remove nearly 2 million b/d, mostly exported to Asia, from world supplies. The sanctions against Iran affect not only the oil markets; they spill over into other aspects of international relations.

The tensions in the oil markets are augmented by tensions building in international affairs, trade, financial markets, and politics toward disruptive events: Europe expanded too fast into former Soviet-dominated areas followed by NATO. Britain is headed out of Europe, Italy is thinking about it, Greece may get kicked out, and Hungary wonders why it is in it. NATO expansion antagonized Russia to take aggressive actions in Ukraine and relations with Turkey have soured. Similarly the US overextended with invasions of Afghanistan and Iraq, caused confrontations it did not need, and has nothing to show for them except instability in both places. US relations with Russia are unclear; Russia is obviously not a friend but also need not be an enemy.

Other trends continued during the summer. US confrontation with China intensified. It became apparent China is self-serving in everything it does; it is an adversary, not an amiable trading partner. The confrontation with China is characterized by tariffs and a trade war which, combined with confrontations with Iran, Russia, and North Korea and attendant sanctions, is dragging along various allies and neighbors. US foreign and trade policies have needed revision for some time; because we waited so long it is causing considerable disruption in our international relations.

These tensions in markets and international affairs are intensifying and converging just as the US prepares for the most contentious and disruptive midterm election in years. The lead-up and follow-up to that election will be characterized by levels of acrimony and antagonism which could render the US government non-functional. This could be a situation which anyone who remembers the effect of Watergate in the 1970s does not want to repeat – the costs of the failures of the US Government in international affairs at that time are still heavy on us and the oil markets today.

As we come out of this period, the US must establish new and revised policies which it can maintain, support, and protect for a protracted period. The United States must decide what it needs for the prosperity and protection of its citizens and decide what it needs to do to secure those needs.

With increasing US oil production and a booming economy, the US is now in a position to establish a position of economic and military strength from which to conduct trade and foreign affairs for the next several decades. Oil is the largest component of international trade and one which causes conflict and economic dislocation with shifts of supply and demand balance and extreme volatility of prices. But this position of strength will not last; the US should now establish long-term supply and market agreements for stability and reliability of oil supply and price. The disruptive effects of price volatility on the economy can be minimized. Oil supply should be taken out of US foreign-policy considerations.